Eating Out and Your Monthly Budget

When it comes to managing your monthly budget, one of the most enjoyable yet often overlooked categories is dining out. Whether treating yourself to a well-deserved meal, catching up with friends over brunch, or indulging in a cozy dinner date, eating out can add a delightful spice to life. However, without a proper budget, those expenses can quickly spiral out of control. So, how much should you realistically set aside each month for these culinary adventures?

Review Your Dining Habits and Preferences

When it comes to your dining habits, it’s important to reflect on what drives your choices. Think about the types of cuisine you enjoy, how often you dine out, and whether you’re indulging in splurges or sticking to more budget-friendly options. These preferences can greatly influence how much you should allocate each month for eating out. Start by tracking your past dining experiences over a few weeks; this can help you identify patterns in your spending and preferences. Consider the following:

- Frequency: How often do you eat out daily, weekly, or just on special occasions?

- Cuisine Preferences: Do you lean towards Italian, Asian, fast food, or something else?

- Meal Time Choices: Are you more inclined to have lunches out, brunches, or late-night dinners?

- Dining Style: Do you prefer casual dining, takeout, or fine dining experiences?

Taking these factors into account will better inform how to budget for your eating-out habits. You can also use this simple budgeting table as a guide:

| Dining Style | Average Cost per Meal | Monthly Frequency |

|---|---|---|

| Fast Food | $10 | 8 times |

| Casual Dining | $25 | 4 times |

| Fine Dining | $75 | 2 times |

By evaluating your habits and using a straightforward approach, you can create a realistic budget that reflects your lifestyle while still enabling you to enjoy the dining experiences you cherish most.

Evaluate Your Income and Financial Commitments

Understanding your monthly income is necessary in determining how much you can allocate for dining out without straining your budget. Start by thoroughly examining your net income, which is the amount you bring home after taxes and other deductions. Break down your income sources, including salary, freelance work, or any side gigs, to get a comprehensive view of your finances.

Once you have a clear picture of your monthly earnings, list out your necessary expenses to identify your financial priorities. These may include:

- Housing costs (rent/mortgage)

- Utilities (electricity, water, internet)

- Groceries (monthly food budget)

- Transportation (gas or public transport)

- Debt payments (credit cards, loans)

After accounting for these fixed expenses, evaluate how much discretionary income you have left for leisure activities like eating out. A useful guideline is the 50/30/20 rule, wherein:

| Category | Percentage | Budget Example (for $3,000 income) |

|---|---|---|

| Necessities | 50% | $1,500 |

| Discretionary Spending | 30% | $900 |

| Savings/Debt Repayment | 20% | $600 |

Based on this framework, you could allocate around 30% of your monthly budget, ensuring your dining out expenses remain within a comfortable range. This balance allows for enjoyment without jeopardizing your financial stability.

Budgeting for Dining That Matches Your Lifestyle

To establish a dining budget that seamlessly aligns with your lifestyle, start by assessing your monthly income and fixed expenses. This foundational step allows you to determine how much disposable income you have available to allocate toward dining out. Consider these factors as you create your budget:

- Frequency of Dining Out: Evaluate how often you realistically enjoy eating out.

- Dining Preferences: Do you lean more towards casual eateries or fine dining experiences?

- Overall Spending Habits: Do you often find yourself overspending when dining out?

Once you have a clearer picture, set a specific percentage of your disposable income to dedicate to dining. A general guideline is to allocate about 10-15% of your budget to eating out, though this can be adjusted based on your unique lifestyle demands. Here’s a simple table illustrating different income levels and corresponding dining budgets:

| Monthly Income | Suggested Dining Budget (10–15%) |

|---|---|

| $2,000 | $200 to $300 |

| $4,000 | $400 to $600 |

| $6,000 | $600 to $900 |

Staying within this budget will help you enjoy your meals while ensuring you maintain a healthy financial balance. Remember, it’s all about finding what works for you while still allowing for the pleasures of dining out.

Affordable Dining and Smart Alternatives

Finding affordable dining options can transform your eating-out budget from a financial burden into a manageable part of your monthly expenses. Start by exploring local deals and happy hours, which frequently feature discounts that can significantly lower your dining costs. Consider these cost-effective strategies:

- Loyalty Programs: Sign up for restaurant loyalty programs that offer exclusive discounts or free items.

- Family Meal Deals: Choose shareable plates or bundled options for better value.

- Off-Peak Dining: Look for off-peak specials or reduced prices.

- Coupons and Online Deals: Use apps and websites for promo codes and discounts.

Additionally, don’t overlook the value of home cooking. Preparing meals at home not only saves money but also tends to be healthier. Consider meal prepping on weekends to minimize cooking during the week. Here’s a simple breakdown of how much you could potentially save by cooking at home:

| Type of Meal | Average Restaurant Cost | Average Home-Cooked Cost | Potential Savings |

|---|---|---|---|

| Lunch | $15 | $5 | $10 |

| Dinner | $30 | $10 | $20 |

| Brunch | $25 | $7 | $18 |

By incorporating these tips into your routine, you can budget more effectively while still enjoying meals out, ensuring you maintain a healthy balance between your dining experiences and financial goals.

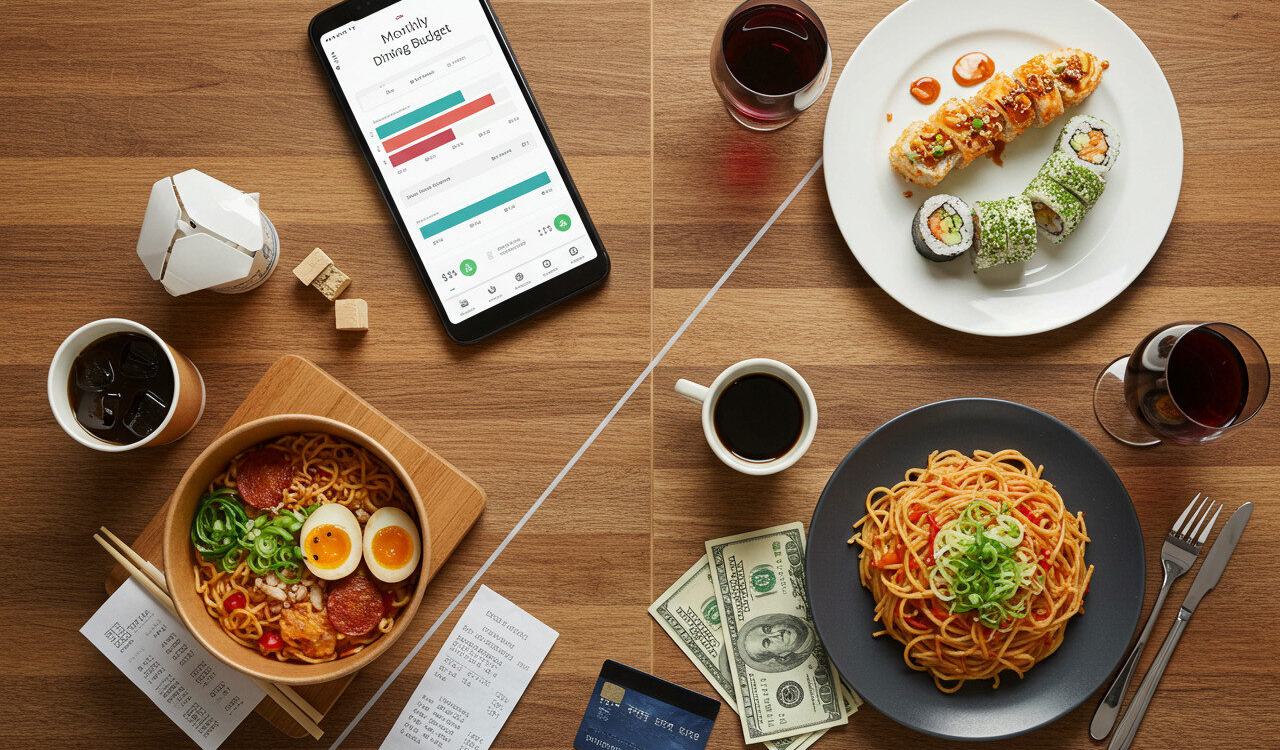

Track Dining Expenses to Stay on Budget

To effectively manage your budget for dining out, it’s important to keep track of your spending habits closely. At first, this might seem tedious, but over time you’ll find it offers valuable insights into where your money is going. Start by reviewing your recent bank statements or credit card transactions; this can help you identify patterns or trends in your eating-out expenses. Consider creating a simple spreadsheet or using budgeting apps to categorize your spending and set limits.

When assessing your spending, pay attention to the following factors:

- Frequency: How often do you dine out each week?

- Type of Meals: Are you opting for fast food, casual dining, or fine dining?

- Regional Costs: How do local food prices affect your budget?

You might find it useful to summarize your monthly spending on eating out in a table format for better visibility:

| Dining Type | Average Spend ($) | Frequency (per month) | Total Spend ($) |

|---|---|---|---|

| Fast Food | 10 | 8 | 80 |

| Casual Dining | 25 | 4 | 100 |

| Fine Dining | 60 | 2 | 120 |

By analyzing this data, you can pinpoint unnecessary expenditures and make more informed decisions about where to cut back, allowing you to stick to your budget while still enjoying a meal out every now and then.

Create a Flexible Plan for Dining Out

Creating a flexible budget for dining out allows you to savor your favorite meals without the weight of guilt hanging over you. Start by assessing your total monthly income and then determine a realistic percentage you can allocate for dining. Many experts recommend setting aside about 10-15% of your income for discretionary spending, which includes eating out. However, your lifestyle and priorities will ultimately dictate this figure.

A practical way to approach your budget is by keeping it adaptable; if one month feels lighter in other expenses, consider reallocating funds to enjoy more meals out. To further enhance your dining experience without overspending, you might find it helpful to track your dining habits and preferences. This can give you insights on where to splurge and where to save. Here’s a simple table to visualize your monthly dining budget:

| Dining Category | Budgeted Amount ($) | Actual Spending ($) |

|---|---|---|

| Casual Dining | 100 | 75 |

| Fine Dining | 50 | 60 |

| Takeout | 80 | 70 |

| Coffee & Snacks | 30 | 40 |

By reviewing your actual spending against your budgeted amounts, you can adjust your lifestyle choices while also allowing for those cherished dining experiences. This balance will empower you to enjoy your meals out without the cloud of financial anxiety.

Final Thoughts on How Much to Budget for Dining Out Each Month

Balancing enjoyment and financial responsibility is important when it comes to dining out. By evaluating your habits, setting a realistic budget, and making conscious spending decisions, you can savor meals guilt-free. Use tools like spending trackers and dining tables to stay on course. With smart planning and flexibility, your love for food can harmonize perfectly with your financial goals.

Frequently Asked Questions

What Factors Should I Consider When Budgeting for Eating Out?

When budgeting for eating out, consider your income, fixed expenses, and overall financial goals. Reflect on your dietary preferences, social habits, and how often you dine out. Also, think about the costs associated with different types of dining, such as fast food versus fine dining. These considerations will help set a sustainable and realistic dining budget.

How Much Do People Usually Spend on Dining Out Each Month?

Spending on dining out can vary widely depending on lifestyle and location. On average, many people allocate about 10–15% of their monthly income for eating out. However, your individual preferences might lead you to spend more or less than this average. Tracking expenses will help personalize your ideal amount.

What Is a Good Starting Budget for Someone New to Tracking Dining Costs?

If you’re new to budgeting, a good starting point might be to set aside 5–10% of your monthly income for eating out. This figure offers flexibility while giving you space to evaluate your habits. Over time, you can refine this amount based on your spending patterns and financial goals.

How Can I Stay Within My Dining Out Budget?

To stick to your budget, consider planning your meals ahead of time and setting a specific dining-out limit for yourself. Track your spending with an app or a journal, and look for deals or discounts. Cooking at home more often and setting clear expectations can help reduce unplanned dining costs.

What If I Exceed My Dining Budget One Month?

If you exceed your budget, take some time to analyze where the extra spending occurred. Identify triggers that led to overspending and adjust your next month’s budget. Create a plan to reduce discretionary spending elsewhere to compensate for the overage and get back on track.

Updated by Albert Fang

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.