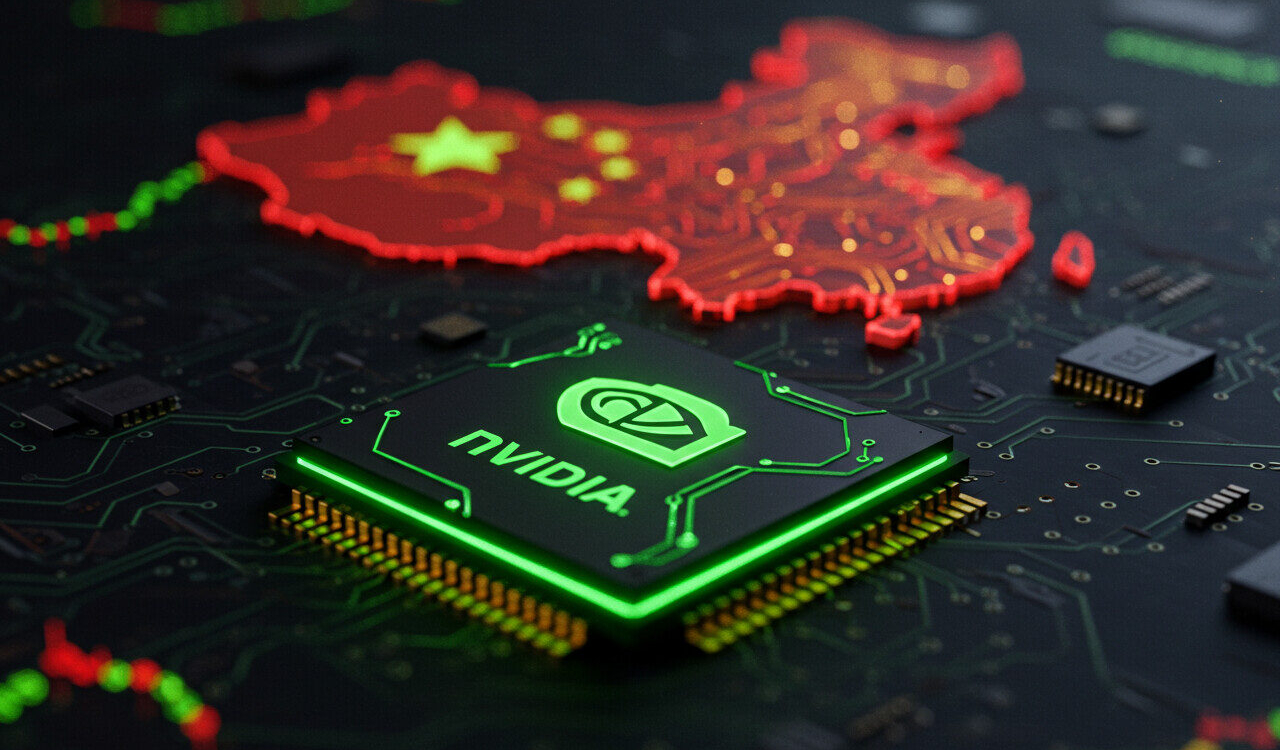

Nvidia’s Position on China Regulations and Its Market Effects

Market Impact and Investment Considerations

Nvidia’s stance on China’s regulatory environment highlights shifts that could influence technology investments. Changes in trade policies and restrictions can cause fluctuations in stock prices, especially in tech sectors. Monitoring these developments helps investors anticipate market movements and adjust strategies accordingly.

Innovation and Competition Challenges

Restrictions on technology markets often lead to reduced innovation and fewer options for consumers. Limited competition tends to push product prices higher, affecting both buyers and investors. This dynamic shapes the availability and advancement of new technology products globally.

Global Relations and Economic Consequences

New rules can increase tensions between countries, influencing international business environments. These changes raise concerns about global economic stability and require consideration of geopolitical risks when making investment decisions.

Historical Policy Effects on Technology Markets

Table: Past Regulatory Events and Their Outcomes

| Event | Implication |

|---|---|

| Bans on tech exports | Decline in market share for affected firms |

| Tariffs on electronic goods | Increased consumer prices |

| Access restrictions | Barriers to innovation and collaboration |

Understanding these trends helps investors navigate volatile markets shaped by evolving regulations.

Interpreting Nvidia’s CEO Message and Market Reactions

Investor Sentiment and Market Volatility

A brief but pointed statement from Nvidia’s CEO regarding China’s rules has influenced investor confidence. Negative sentiment may drive stock prices down, while uncertainty contributes to volatile market conditions, especially in tech-related sectors.

Supply Chain Considerations

Shifts in trade regulations can disrupt supply chains, prompting businesses to reassess sourcing and manufacturing locations. These disruptions often lead to broader implications across multiple industries.

Sector-Specific Impacts

Table: Regulatory Effects on Key Sectors

| Sector | Potential Impact |

|---|---|

| Technology | Heightened price fluctuations due to Asian dependence |

| Consumer Goods | Variability in pricing and product availability |

| Finance | Adjustments in portfolio risk management approaches |

Managing risk dynamically allows investors to protect assets and optimize returns during uncertain times.

Implications for Businesses Operating in or With China

Adapting to Regulatory Changes

Companies engaged with the Chinese market must stay informed and ready to modify operations. Trade regulations may affect partnerships, supply chains, and compliance requirements, necessitating proactive strategies.

Recommended Business Practices

- Conduct Compliance Reviews: Regularly verify adherence to local laws and regulations.

- Explore Market Diversification: Identify alternative markets to reduce dependency on China.

- Enhance Risk Management: Develop systems to detect and respond to regulatory changes promptly.

- Maintain Open Communication: Foster dialogue among employees, partners, and stakeholders to ensure agility.

Regulatory Impact on Business Operations

Table: Policy Effects and Recommended Actions

| Regulation | Potential Impact | Recommended Action |

|---|---|---|

| Data Privacy Laws | Increased compliance costs | Invest in data protection tools |

| Trade Tariffs | Higher import/export expenses | Diversify supplier base |

| Labor Regulations | Operational limitations | Strengthen workforce policies |

Effective preparation supports business resilience and growth amid regulatory uncertainties.

Adjusting Investment Strategies for Regulatory Uncertainty

Portfolio Management Tips

- Diversify Investments: Spread assets across sectors to mitigate risk.

- Stay Updated: Follow industry news and regulatory developments.

- Prioritize Fundamentals: Focus on companies with strong financial health capable of weathering external challenges.

Risk Assessment for Portfolio Impact

Table: Scenarios Affecting Tech Stocks

| Scenario | Impact | Recommended Action |

|---|---|---|

| Stricter China Regulations | Possible stock decline | Reduce exposure |

| Increased Domestic Demand | Growth opportunities | Reinvest locally |

| Supply Chain Disruptions | Market volatility | Maintain cash reserves |

Ongoing adjustment enhances resilience against market fluctuations and regulatory shifts.

Nvidia’s Approach to Risk Management

Lessons from Nvidia’s Transparency

Nvidia’s open communication about regulatory challenges demonstrates a model for managing uncertainty. Clear updates on compliance status reduce confusion and build trust among stakeholders.

Flexibility in Strategy

Adapting quickly to regulatory changes is vital. Nvidia’s example highlights the importance of maintaining flexibility in business and investment plans.

Checklist for Managing Regulatory Risks

- Stay Informed: Monitor evolving rules impacting investments.

- Promote Transparency: Communicate plans clearly with partners.

- Be Adaptable: Adjust strategies based on new information.

Applying these principles helps safeguard assets and navigate challenges effectively.

Building Knowledge in a Changing Regulatory Environment

Staying Current and Engaged

Regularly consuming industry news and participating in expert discussions provides insights into shifting regulations. Engaging with peers and specialists supports informed decision-making.

Understanding Global Risk Factors

Recognizing how international politics affect local rules aids in risk reduction when managing investments or business operations.

Comparing International Regulatory Landscapes

Table: Regulatory Profiles by Region

| Country | Regulation Highlights | Impact on Business |

|---|---|---|

| USA | Emphasis on innovation, limited restrictions | Encourages growth and investment |

| China | Strict data and technology controls | High compliance costs, need for partnerships |

| EU | Strong data privacy laws (GDPR) | Requires marketing and operational changes |

Building expertise in these areas supports confident decision-making amid global uncertainty.

China’s Domestic AI Chip Development as a Response

China’s efforts to counter U.S. embargoes through local AI chip production reflect a broader trend toward technological self-reliance, which could reshape global supply chains and competition.

Conclusion

Nvidia’s evolving stance on China’s regulations has widespread effects on markets, innovation, and international relations. Businesses and investors must stay informed and flexible to manage risks and leverage opportunities. Transparency and adaptability, as shown by Nvidia, are vital in navigating a complex global landscape.

The interplay between regulatory policies and technology markets demands vigilance and strategic adjustments. Clear communication and ongoing risk assessment empower investors and businesses to thrive despite uncertainties. Staying informed and prepared enables sound decisions that safeguard financial goals in an ever-changing environment.

Frequently Asked Questions

What did Nvidia’s CEO communicate about China’s new rules?

Nvidia’s CEO indicated the company will comply with updated export regulations, signaling readiness to adapt business operations accordingly.

How does this message illustrate Nvidia’s China strategy?

The brief statement reflects a commitment to maintaining presence in China by navigating regulatory constraints and continuing market engagement.

Why is Nvidia especially affected by China-related regulations?

China represents a significant market for Nvidia’s products, making adherence to export rules crucial for sustained growth.

How might investors respond to Nvidia’s message on China?

Investor reactions will vary, with confidence influenced by perceptions of Nvidia’s risk management and adaptability in the face of regulatory challenges.

Updated by Albert Fang

Source Citation References:

+ Inspo

There are no additional citations or references to note for this article at this time.