4 min read

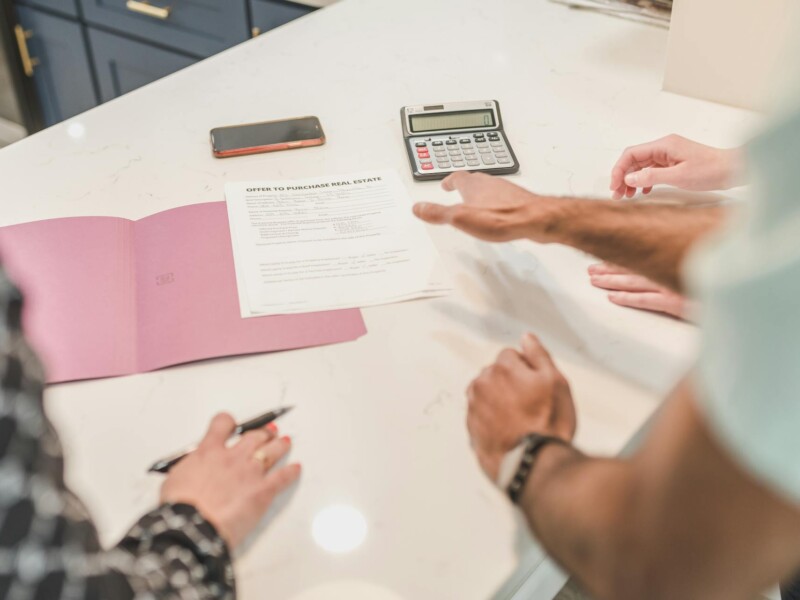

Do You Get a Tax Credit for Buying a House? How to Maximize Your Tax Savings

4 min readWhile a federal tax credit for buying a house in 2023 doesn’t exist, homeowners can benefit from several tax deductions. A primary residence has potential tax benefits, including deductions for mortgage interest, property taxes, and certain home improvements. Understanding the difference between tax deductions and credits is vital for maximizing your savings. Before […]Continue reading "Do You Get a Tax Credit for Buying a House? How to Maximize Your Tax Savings"